The Complete Rapid Cook Oven Guide 2025

Rapid-Cook Oven Buyer's Guide

Understanding Rapid-Cook Technology

Rapid-cook ovens are menu multipliers disguised as countertop appliances. They combine microwave energy with conventional heating elements to cook food faster than traditional methods while maintaining quality. Think of them as the evolution from "we only serve cold subs" to "we can toast, melt cheese, and expand our entire menu" with a single piece of equipment.

The technology is straightforward but effective: a powerful magnetron excites water molecules inside the food (internal heating) while electric coils provide external browning and crisping. This dual-action approach allows a convenience store to compete with a full-service restaurant's menu offerings from a 2-square-foot footprint.

Turbochef i5 - Premium Tier

Merrychef eikon - European Engineering

Market Reality: The Numbers

Analysis of 237 rapid-cook oven sales over the past year reveals the dramatic spread between retail and auction pricing. This gap represents both opportunity and risk.

Auction Price Distribution

- Under $100: 13% (parts units or severe damage)

- $100-$500: 52% (used, untested, cosmetic issues)

- $500-$1,000: 14% (clean used units, working condition likely)

- $1,000-$3,000: 9% (recent models, good cosmetic condition)

- Over $3,000: 12% (new, scratch-dent, or conveyor models)

Brand Hierarchy: Turbochef vs Merrychef

Turbochef commands 85% of the auction market (201 of 237 sales). This isn't just brand preference—it reflects installed base, parts availability, and technician familiarity. Merrychef produces quality equipment, but in the secondary market, volume matters for serviceability.

Turbochef Model Breakdown

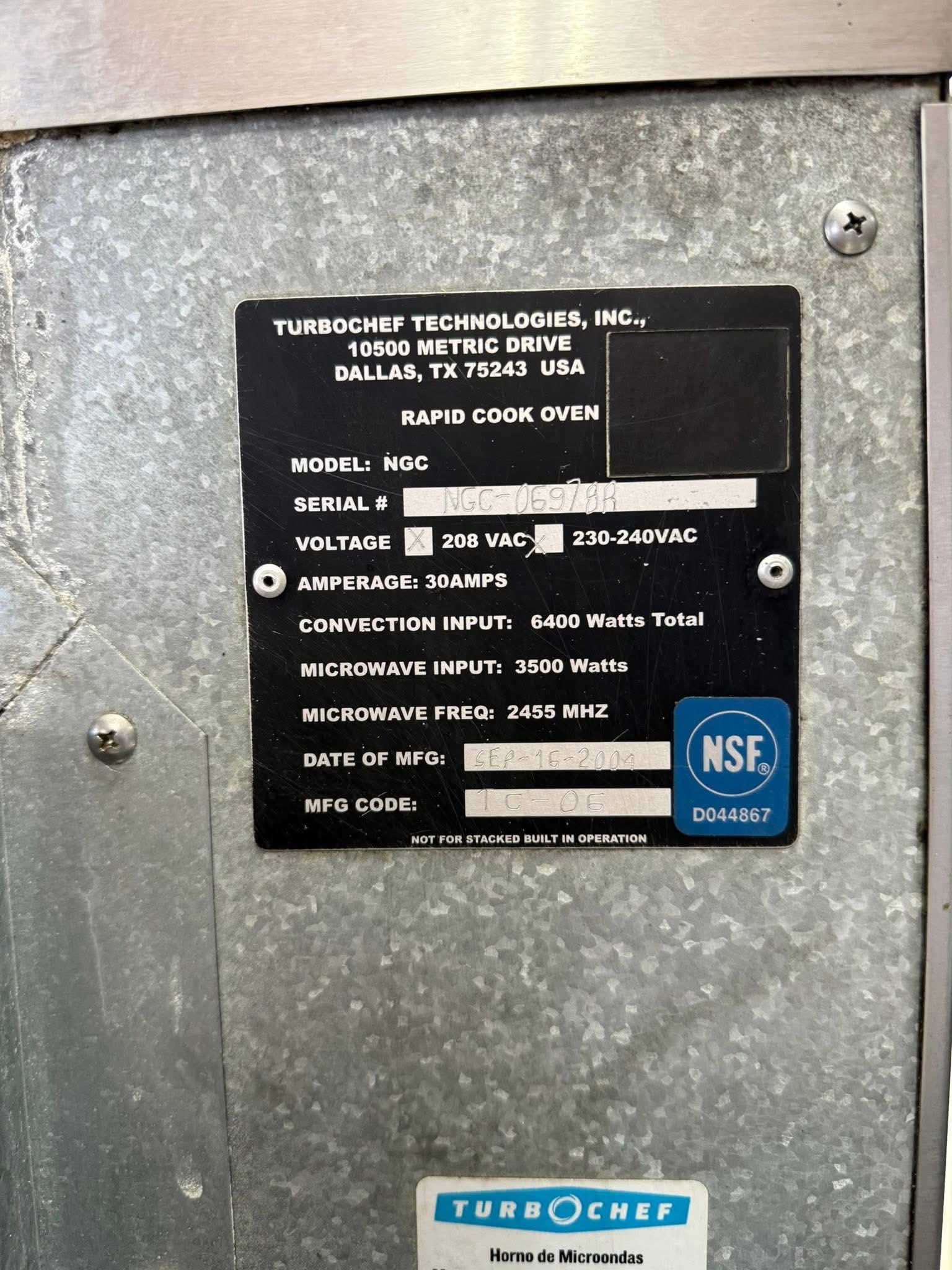

NGO/NGC Series (Workhorses): These are the bread-and-butter auction units. The NGC (44 sales) and NGO (44 sales) represent the most common models you'll encounter. Entry-level pricing at auction ($100-$400 range), with ventless operation and straightforward impingement/microwave technology. The NGC uses the same cooking platform as higher models but in a more compact chassis. These are the units that powered the Subway expansion into hot sandwiches.

Encore Series (Popular Mid-Tier): The Encore and Encore 2 (23 sales) combine impingement and microwave technology with better build quality than the entry models. Auction pricing typically $300-$800. The Bullet variant adds radiant heat to the mix for improved browning. These units show up frequently because they were widely adopted by fast-casual chains.

i-Series (High Performance): The i3 and i5 models represent maximum speed and capacity. The i5 has a larger cavity and more power. At auction, these command premium prices ($1,500-$5,000) even when used, because retail pricing reaches $15,000-$20,000. When you see these, condition matters more than usual—they're worth inspecting closely.

HHC Series (Conveyor Ovens): These aren't countertop units—they're production workhorses. The HHC2020 uses a conveyor belt system and can be stacked. Auction prices run $1,000-$4,500. These are 208/240V three-phase, which limits installation locations but increases capacity significantly. When bidding on conveyor models, verify you have the electrical infrastructure.

Merrychef eikon Series

Merrychef's eikon line tiers by speed and heating method. The e1s and e2s are compact units combining microwave, impingement, and convection—the e2s being faster and café-focused. The e3 emphasizes reheating and baking with convection and microwave. The e4/e4s series delivers high-performance impingement for fastest cook times in fast-casual settings. The e5 is their largest model with half-sheet pan capacity for high-volume operations.

At auction, Merrychef units (19 sales) typically sell in the $200-$1,100 range. Lower volume means less market data, but condition and model determine value more than brand loyalty.

Critical Inspection Points

Unlike most auction equipment, rapid-cook ovens arrive untested. Testing requires 208/240V power—not standard in warehouse settings without a generator. This means you're buying on visual inspection and cosmetic condition alone.

The Door Latch Interlock (Primary Failure Point)

The door latch interlock is the most common failure on these units. It's a safety mechanism that prevents the magnetron from firing unless the door is properly closed. Debris in the latch, worn components, or misalignment causes the unit to appear completely dead. Of 30 Turbochef Tornado units tested in-house, 10 required only latch-related repairs to restore function.

The interlock itself is rarely photographed because it's small and unassuming. Look for the slot or mechanism in the top left of the cooking cavity. During preview, open and close the door multiple times. It should latch firmly with a positive click. Any looseness, grinding, or incomplete latching suggests problems.

Cosmetic Red Flags

- Chassis Damage: Dents, cracks, or structural damage to the stainless steel body suggest rough handling. Internal components are tightly packed—external damage often correlates with internal issues.

- Power Cord Condition: These units pull significant amperage. Damaged, frayed, or modified power cords are safety hazards and indicate poor maintenance.

- Missing Covers or Panels: Rapid-cook ovens have tight tolerances. Missing panels affect ventilation and suggest parts have been scavenged.

- Control Panel Damage: Cracked screens, non-responsive buttons, or water damage to touchscreen interfaces are expensive repairs. Control boards run $500-$1,500.

What Clean Condition Tells You

A clean, complete unit with good cosmetic condition has a high probability of functionality. From field testing 30 used Turbochef units: 12 worked immediately, 10 needed minor repairs (primarily door latch issues), and only 8 had major failures (magnetron, heating element, or control board). Clean equipment suggests proper care during operation, which extends to maintenance habits.

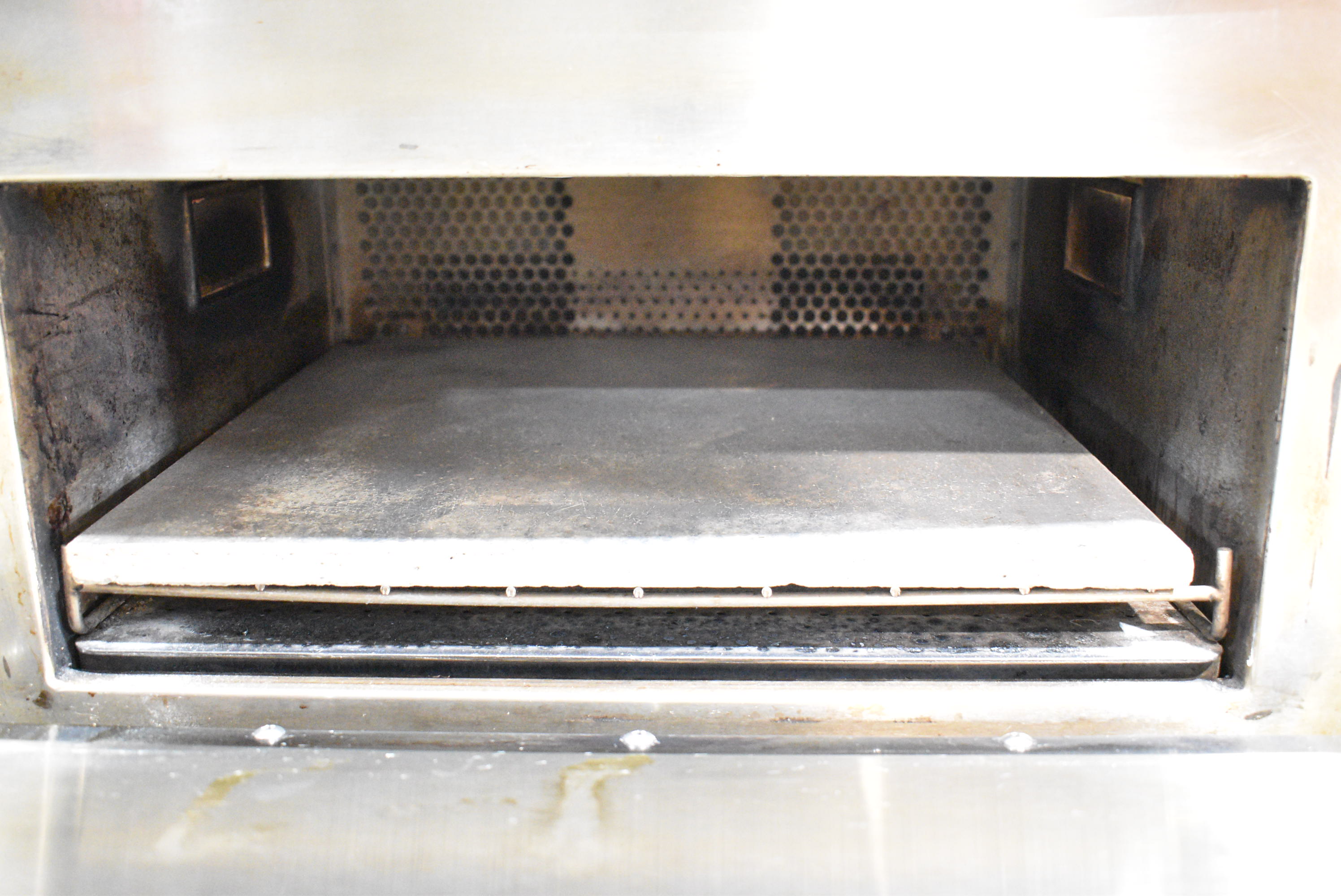

Interior Cavity Variations

Some models feature cooking stones or specialized bases. These aren't universal—many units operate with metal shelves or simple platforms. The stone improves heat distribution and provides a traditional pizza oven effect for certain applications. If present, check for cracks or damage. Replacement stones are model-specific and can run several hundred dollars.

Electrical Requirements and Installation

Every rapid-cook oven requires 208/240V single-phase power. This is non-negotiable. The single-phase requirement exists because these units serve convenience stores, gas stations, and quick-service restaurants—locations where three-phase power is uncommon. The exception is conveyor models (HHC series), which often require three-phase due to higher power consumption.

Amperage draw varies by model but typically ranges from 20-50 amps. This means dedicated circuits in most installations. Verify your location can handle the load before bidding. A $300 auction buy becomes expensive when you need an electrician to run new circuits.

The Ventilation Advantage

Rapid-cook ovens are self-contained with internal ventilation. No hood system required. This is a massive installation advantage over traditional convection or pizza ovens. You need electrical power and counter space—that's the entire requirement. This flexibility explains their popularity in non-traditional foodservice locations.

Size, Weight, and Physical Realities

These units are deceptively heavy. A countertop rapid-cook oven weighs approximately 200 pounds. The compact design and stainless construction fool buyers during preview. Plan for proper lifting equipment and multiple people. The support legs are not robust—once positioned, avoid moving the unit by dragging or scooting. Leg failure is common from lateral forces.

Internal capacity ranges from 0.6 cubic feet (compact models) to 2.2 cubic feet (larger countertop units). Some models accommodate half-sheet pans. The cavity size determines throughput—smaller units work for low-volume operations or specialty items, while larger cavities handle higher demand. Conveyor models like the HHC series operate differently, with capacity measured by belt speed and cooking time rather than cavity volume.

The Safety Reality: Capacitors Can Kill

⚠️ Critical Safety Warning

Rapid-cook ovens use high-voltage capacitors to step up electrical power for the magnetron. These capacitors store lethal voltage even when the unit is unplugged. Capacitors can hold charge for extended periods and can "recollect" charge from ambient static electricity.

Do not attempt repairs unless you have specific training in high-voltage appliance repair. Discharge procedures require proper tools and knowledge. Capacitor failure can cause instant death. This isn't hyperbole—it's electrical reality.

If you need repairs, hire a qualified commercial appliance technician familiar with microwave technology. The $150-$300 service call is cheaper than the alternative.

Beyond the capacitor danger, these units pack components tightly. Everything is difficult to access. Specialty tools and manufacturer-specific knowledge are necessary for anything beyond door latch cleaning. Parts availability for major brands (Turbochef, Merrychef) is reasonable, but installation requires expertise.

Self-Diagnostics: The Buyer's Advantage

Most rapid-cook ovens include self-test and diagnostic functions. Access methods vary by model and manufacturer, but these diagnostics allow in-house troubleshooting without opening the unit. During auction preview, ask if staff can power up the unit (if a generator is available) and run the self-test sequence.

The diagnostic mode typically cycles through major components: magnetron function, heating element continuity, fan operation, and door latch status. Error codes display on the control panel. This is valuable intelligence—a unit that passes self-diagnostics has dramatically higher functionality odds than one that fails or won't power up.

Programming and recipe management works similarly. Used units usually retain previous operator programs. Clearing and adding recipes is straightforward through the control panel menus. Manufacturers provide programming guides, and the process resembles setting up a programmable thermostat more than computer programming.

The Menu Multiplier Value Proposition

Understanding the business value helps justify auction prices. A rapid-cook oven transforms limited-menu locations into expanded foodservice operations. The classic example: Subway's shift from cold sandwiches only to toasted subs. One appliance, installed in one day, fundamentally changed the menu and revenue potential.

Gas stations and convenience stores represent the strongest use case. These locations have customer traffic but limited kitchen infrastructure. A rapid-cook oven enables fresh pizza, hot sandwiches, breakfast items, and reheated prepared foods—all from a countertop unit requiring only electrical power. The ROI is measured in months, not years.

Full-service restaurants find less utility because rapid-cook ovens optimize for speed over capacity. The small cavity size becomes a bottleneck during rush periods. However, for specific applications—reheating prepared desserts, finishing pre-cooked proteins, or specialty items requiring consistent timing—they excel.

Bidding Strategy and Value Assessment

The auction price distribution reveals clear tiers. Units under $100 are parts machines or have obvious major damage. The $100-$500 range represents the bulk of the market—used equipment with unknown functionality but acceptable cosmetic condition. This is where most buyers should focus.

Smart Bidding Approach

- $100-$300 range: Budget for potential door latch repair or minor component replacement. Total investment (purchase + repair) still delivers massive value versus retail.

- $300-$500 range: Expect good cosmetic condition, complete units, recent model years. Functionality probability increases in this tier.

- $500-$1,000 range: Near-certain functionality, minimal repairs needed. Clean units from closed restaurants with maintained equipment.

- Over $1,000: You're competing with dealers or buyers seeking specific models. Verify the premium is justified—either new/scratch-dent condition or high-demand models like the i-series.

Brand matters less than condition at these price points. A clean Merrychef at $250 offers better value than a rough Turbochef at $400, even considering market share differences. Focus on what you can verify visually: chassis condition, door operation, control panel function, and completeness.

Post-Purchase: First Steps

After winning the bid, handle transportation carefully. These units are heavy and have delicate legs. Use a pallet jack or dolly. Once delivered, inspect electrical requirements before attempting to power up. Verify the outlet matches the voltage and amperage specifications.

First power-up should happen with someone present who can immediately shut off power if problems arise. Many units will initialize with beeps, display checks, and fan tests. This is normal. If the unit appears dead, check the door latch first—clean the mechanism and verify proper closure before assuming major component failure.

If self-diagnostics are accessible, run them immediately. Document error codes. This information is valuable for technicians if professional service becomes necessary. For units that power up successfully, run a simple test with a cup of water. Heat distribution and timing provide baseline functionality data.

Parts, Service, and Long-Term Ownership

Turbochef and Merrychef maintain robust parts networks. Door latches, magnetrons, heating elements, and control boards are available through authorized service centers and commercial parts suppliers. Lead times vary but major components typically ship within a week.

The catch: installation requires expertise. Door latch replacement is manageable for mechanically-inclined owners. Everything else enters dangerous territory. Magnetron replacement involves high-voltage capacitor handling. Control board swaps require disassembly of tightly-packed components. Budget $150-$300 per service call for professional help.

Routine maintenance is minimal. Keep the cavity clean, inspect the door latch periodically for debris, and verify door gasket integrity. The self-contained ventilation system includes filters—check manufacturer specs for replacement intervals. Beyond this, rapid-cook ovens are designed for low-maintenance operation in busy foodservice environments.

What the Data Reveals

Analysis of 237 sales over the past year shows consistent patterns. Turbochef's market dominance (85% of sales) creates a self-reinforcing cycle—more units in service means more secondary market availability, which increases technician familiarity and parts distribution. This benefits buyers even if Merrychef produces comparable equipment.

The median price of $290 versus retail pricing of $5,000-$23,000 reflects the risk premium of untested equipment. Buyers pay 5-15% of retail because functionality is uncertain. Even accounting for potential repair costs ($500-$1,500 for major components), the economics favor auction purchases for anyone with basic mechanical aptitude or access to qualified technicians.

New and scratch-dent units (the top 12% selling over $3,000) command premium prices because they eliminate functionality risk. These purchases make sense for buyers who need immediate deployment without repair delays or for those lacking in-house repair capability.

Final Assessment

Rapid-cook ovens represent some of the highest value density in restaurant equipment auctions. The combination of high retail prices, strong secondary market demand, and straightforward troubleshooting creates opportunity for informed buyers. Understanding door latch interlocks, respecting electrical requirements, and accurately assessing cosmetic condition separates successful bidders from those who overpay or acquire problem units.

The safety considerations are real—high-voltage capacitors demand respect. But the repair reality is often simpler than feared: many "dead" units need only latch cleaning or minor adjustments. For $200-$400 at auction, you're buying a menu transformation tool that retails for $5,000-$15,000. Even with repair costs, the value proposition holds.

Focus on Turbochef NGO, NGC, and Encore models for best parts availability and market liquidity. Verify electrical capability at your location before bidding. Inspect cosmetic condition and door operation during preview. Budget for potential door latch or minor component repair. With these fundamentals, rapid-cook oven auctions become high-probability investments rather than gambles.

Ready to Bid on Commercial Equipment?

PCI Auctions offers 600-900 lots weekly of restaurant and foodservice equipment.

Preview in person, inspect before bidding, and leverage auction pricing for your operation.

View Current Auctions