Combi-Oven Buyers Guide 2025

The Complete Commercial Combi Oven Buyer's Guide 2025

Master combi oven buying with real auction data from 283 sales. Understand Rational, Blodgett, Alto-Shaam performance, steam injection technology, installation requirements, and bidding strategy for the kitchen's ultimate force multiplier.

The Force Multiplier: Why Chefs Lobby for Combis

"I fought against getting a combi oven initially. Why do we need it? After a month of being able to check the progress of our signature dish, prime rib, remotely from wherever I was, I insisted we get another for our brisket. Even when the line forgets to set a timer, the oven can tell you how far along you are."

This testimonial captures the combi oven phenomenon perfectly. Chefs don't just tolerate these machines—they become evangelical advocates. Once a kitchen adds a combi, the chef starts annual CapEx conversations: "Well, if we had that COMBI I mentioned last quarter we could..." Year after year. Adding it to purchase requests. Building business cases. Making it happen through persistence.

The combi oven represents the rare intersection where technology enhances rather than replaces culinary skill. It doesn't dumb down cooking—it amplifies the chef's control. Steam injection. Convection heat. Precision temperature management. Humidity control. Programmable multi-stage cooking cycles. Smartphone monitoring. All in one unit. This isn't gadgetry for gadgetry's sake. It's functional technology that solves real kitchen problems.

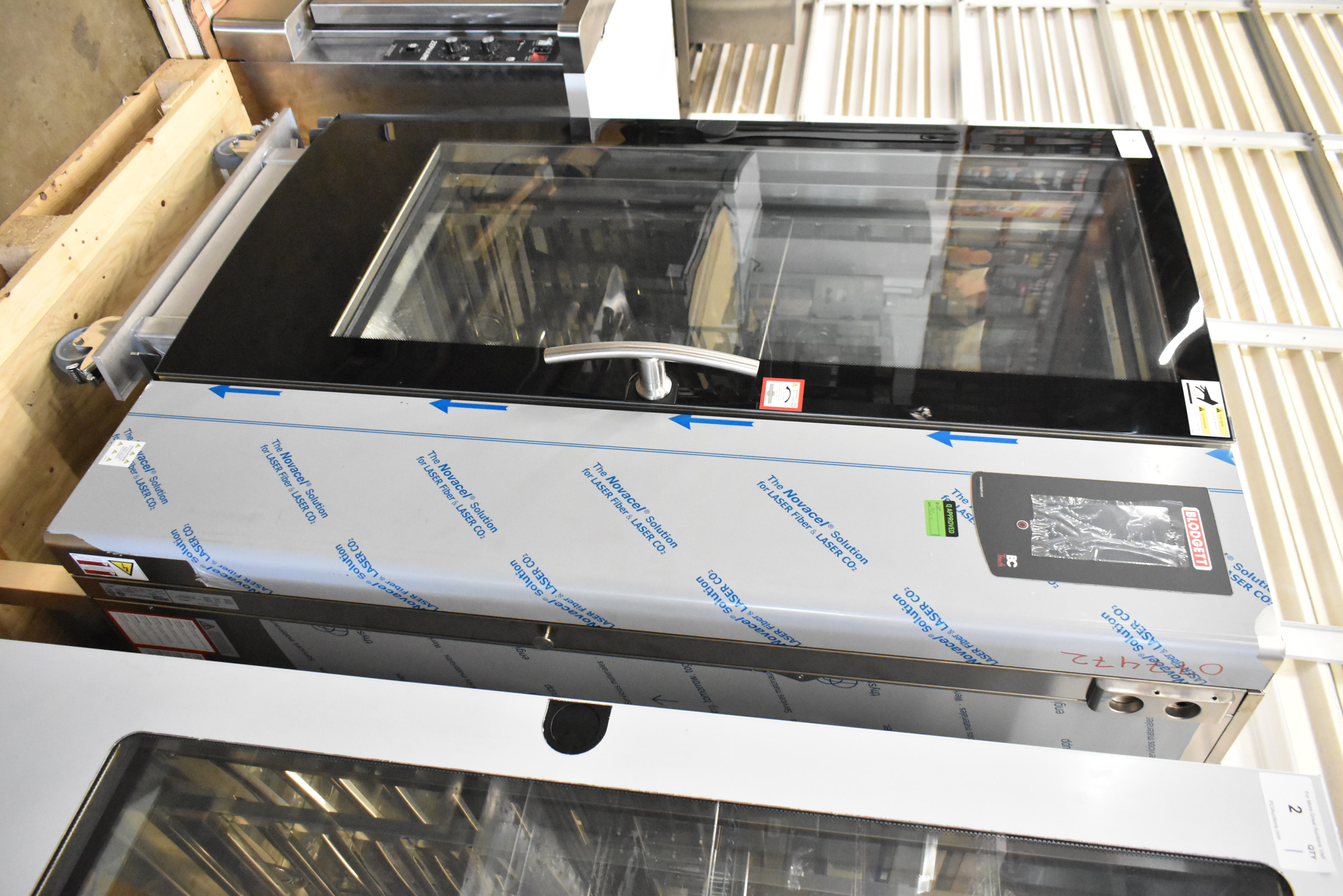

Blodgett BCT-202/KPE roll-in rack combi oven—brand new scratch-and-dent units command $6,000-$8,000 at auction versus $20,000+ retail

Combis combine techniques professional kitchens have used for decades: steaming, convection roasting, low-temperature cooking, even sous vide precision. The breakthrough isn't inventing new techniques—it's combining them with fine control over temperature, airflow, and humidity in a single unit. Want to steam vegetables while roasting potatoes while gently bringing prime rib to 128°F internal temperature? One unit handles all three simultaneously. That's the force multiplier effect.

There are no dishes that are "combi exclusive"—you can make the same results using other kitchen tools. But the combi's ability to combine cooking methods and produce results as good or better than dedicated equipment is the differentiator. Crispier fried foods with less oil. Better steamed vegetables that retain color and texture. Delicate cold smoking on fish. Combis handle it all on the same shift. Combined quality results from a single unit. That's why chefs love them.

Our analysis of 283 commercial combi oven sales over 12 months reveals pricing patterns, brand performance hierarchies, and inspection intelligence unavailable elsewhere. From $21 parts units to $13,500 brand-new premium models, this guide translates auction floor reality into bidding strategy. Whether you need a countertop unit for a small café or a roll-in rack beast for institutional production, understanding combi fundamentals prevents expensive mistakes.

Market Reality: 283 Sales Analyzed

- Total sales: 283 commercial combi ovens over 12 months

- Median price: $525 (functional used units)

- Mean price: $1,679 (elevated by premium BNSD units)

- Price range: $0.01 to $13,500

- 25th percentile: $140 (parts/incomplete tier)

- 75th percentile: $2,500 (quality working units)

The BNSD Premium Reality: Brand-new scratch-and-dent units command median $3,450 versus $299 for used equipment—an 11.5X premium that eliminates functionality risk entirely while delivering 40-60% retail savings.

The $525 median versus $210 for dishwashers and $215 for ranges reveals combi ovens' premium positioning. These aren't commodity items—they're precision cooking technology commanding serious money even at auction. The gap between median ($525) and mean ($1,679) reflects the massive BNSD sector influence: 92 brand-new units (32.5% of volume) selling at premium pricing.

Compare this to dishwashers and ranges where BNSD units represent smaller market segments. Combis attract different buyers: operators making substantial capability upgrades rather than replacing failed equipment. This fundamental difference drives pricing psychology—buyers pay premiums for game-changing capability rather than hunting absolute bargains for operational necessities.

Price Distribution by Tier

| Price Range | % of Sales | Typical Condition |

|---|---|---|

| Under $100 | 18.7% | Parts units, incomplete machines, severe damage |

| $100-$500 | 29.3% | Used equipment, unknown condition, older models |

| $500-$1,000 | 8.1% | Better condition used units, complete assemblies |

| $1,000-$2,000 | 13.4% | Recent models, likely functional, good cosmetics |

| $2,000-$3,000 | 8.1% | Near-certain functionality, minimal repairs needed |

| $3,000-$5,000 | 11.7% | BNSD entry tier, premium used units |

| $5,000-$10,000 | 9.9% | Premium BNSD, roll-in racks, top-tier brands |

| Over $10,000 | 0.7% | Brand new premium models, specialty configurations |

Brand Performance Hierarchy

Brand reputation significantly impacts combi oven auction pricing. Unlike ranges where functionality differences are modest, combis deliver genuinely different capabilities across manufacturers. The technology integration, programming sophistication, and feature sets vary dramatically:

| Brand | Units Sold | Median Price | Price Range | Market Position |

|---|---|---|---|---|

| Blodgett | 43 | $4,000 | $18 - $8,250 | Premium BNSD leader |

| BKI | 14 | $3,849 | $80 - $7,751 | Roll-in specialist |

| Cleveland | 4 | $1,860 | $250 - $2,500 | Middleby group quality |

| Convotherm | 11 | $1,700 | $4 - $6,800 | German engineering |

| Rational | 86 | $720 | $0.01 - $13,500 | Volume leader, cult following |

| Alto-Shaam | 99 | $185 | $0.01 - $3,000 | Volume champion, value tier |

Blodgett AETE101R—Middleby Group premium engineering with full feature sets commanding $4,000 median auction pricing

Blodgett: The BNSD Premium Leader

Blodgett dominates premium auction pricing through Middleby Group engineering and consistent BNSD inventory. The $4,000 median reflects brand-new scratch-and-dent units flowing from manufacturer channels—cosmetically imperfect machines rejected from retail but functionally identical to showroom models. These units deliver 40-60% retail savings for minor cosmetic compromises invisible in back-of-house installations.

We have the absolute privilege of receiving and liquidating brand-new overstock and scratch-and-dent inventory of these high-quality units. They command premiums at auction but offer significant savings compared with retail. We only get them from time to time so be prepared when you see them!

Blodgett's model range spans countertop to full roll-in rack configurations. The BLCT series represents standard installations, while BCT/BCP roll-in models serve institutional applications. All feature tech-forward controls, WiFi connectivity options, and comprehensive programming capability. This is Middleby Group territory—all the bells and whistles across the full size spectrum.

Blodgett ABTG061R natural gas combi—rare gas-powered configuration for facilities without adequate electrical infrastructure

Rational: The Cult Brand Paradox

Rational is the "Cadillac" of combi ovens—everyone knows the brand, chefs request them specifically, operators brag about ownership. Yet the $720 median seems inconsistent with this reputation. The explanation: volume and model diversity. 86 units sold (30% of market share) include everything from older CombiMaster and SelfCookingCenter models to premium iCombi Pro units.

Rational iCombi Pro with UltraVent Plus ventless hood—the aspirational model chefs lobby for year after year

Breaking down Rational by model family reveals the hierarchy:

- iCombi Pro: $1,250 median (27 units)—the modern flagship with Connected Cooking, smartphone integration, advanced programming

- CombiMaster/SelfCookingCenter: $620 median (35 units)—older generations, mechanical controls, proven reliability but lacking modern features

The iCombi Pro drives the cult following. This is what chefs mean when they say "Rational." Connected Cooking launched around 2017, bringing smartphone monitoring, recipe integration, remote control, and HACCP compliance automation. For chefs who've experienced this capability, older units feel primitive. For chefs who don't care about connectivity? The older Rational models deliver identical steam and convection cooking at significant discounts.

The Rational Model Evolution Reality

CombiMaster and SelfCookingCenter models from pre-2017 lack smartphone integration but cook identically to modern units. Steam is steam. Convection is convection. The programming sophistication differs, but fundamental cooking capability remains constant. For operators prioritizing function over features, older Rational models at $620 median represent exceptional value versus $1,250+ for iCombi Pro units.

But understand the chef psychology: if they've used an iCombi Pro elsewhere, they'll want the iCombi Pro. The features create operational advantages—recipe programming, remote monitoring, HACCP automation—that simplify workflow even for conservative chefs skeptical of technology.

Alto-Shaam: The Underestimated Contender

Alto-Shaam leads auction volume (99 units, 35% of sales) but commands the lowest median pricing ($185). This paradox reflects brand perception rather than capability. Alto-Shaam dominated holding cabinets for decades—"throw it in the Alto-Shaam" became industry shorthand for hot-holding food. This association creates preconceptions: "What do they know about combi ovens?"

Alto-Shaam CTP10-10EVH with ventless hood and stand—premium quality battling brand perception challenges

The answer: quite a bit. Don't let auction bids fool you—Alto-Shaam produces top-notch competitors with comprehensive feature sets, reliable construction, and adequate service networks. The CTP10-10E model dominated our database (55 units) because it serves mainstream restaurant applications effectively. This is the workhorse specification most operations actually need.

The pricing discount creates opportunity. Alto-Shaam units deliver similar functional capability as Rational or Blodgett at fraction of acquisition cost. For operators prioritizing budget efficiency over brand prestige, Alto-Shaam represents compelling value. The machines cook. They steam. They program. They work. And they cost dramatically less at auction because other bidders chase brand names.

Convotherm: The German Engineering Alternative

Convotherm occupies the $1,700 median tier—premium pricing reflecting German engineering reputation without Rational cult status. These units compete directly with mid-tier Rational models (CombiMaster/SCC) and upper-tier Alto-Shaam configurations. The brand delivers solid all-around performance with feature sets matching the competition.

Convotherm OES-6.10 BNSD—German engineering at auction delivers value without supply chain delays

The auction advantage: no reliance on supply chain to get it to you. Combis ordered new from manufacturers involve 8-16 week lead times typically. Equipment gets manufactured, shipped to distributor, then delivered on scheduled timeline. Convotherm at auction? Available next day. This immediate availability provides substantial value for operations replacing failed equipment or opening on compressed schedules.

What Combi Ovens Actually Do

Commercial combi ovens combine cooking techniques kitchens have employed separately for decades: steaming, convection roasting, low-temperature cooking, humidity-controlled baking, even sous vide precision. The breakthrough isn't new technique invention—it's combining them with fine control over temperature, convection airflow, and humidity levels in a single programmable unit.

The Core Capabilities

Steam injection introduces moisture into the cooking chamber at controlled rates. This isn't simply "adding water"—it's precision humidity management. Want 40% relative humidity for bread proofing? Set it. Need 100% steam saturation for vegetable cooking? One button. The steam generation system (typically a boiler or direct steam injection) delivers controlled moisture on demand.

Convection heat circulates hot air throughout the chamber using fan systems. Unlike static ovens where heat rises and creates temperature zones, convection delivers consistent temperature across all positions. This eliminates hot spots and cold zones that plague traditional cooking equipment.

Combined cooking represents the fundamental advantage. Simultaneous steam and convection creates cooking environments impossible with dedicated equipment. Example: roasting chicken with 30% humidity maintains moisture in breast meat while allowing skin to crisp. You cannot achieve this with a steamer (too wet) or a convection oven alone (too dry). The combination creates the optimal environment.

Multi-stage programming automates technique transitions within single cooking cycles. Start with steam and convection for speed, transition to convection-only for texture development, finish with high heat for browning. The oven executes automatically. No chef standing there making manual adjustments. Program it once, repeat it consistently.

Combi oven interior showing pan rack configuration—half-sheet or full-sheet capacity depending on model size

Why They Cook Differently: The Physics

Air is a poor thermal conductor. It heats quickly but loses heat quickly. Drop a cold pan of food into a traditional convection oven and watch the temperature plummet. The air cools rapidly, requiring time to recover before cooking resumes. This creates uneven results—food on the edges cooks faster than interior items because edge pieces are exposed longer to recovered temperatures.

Water takes longer to heat but retains thermal energy much more effectively. The thermal mass of steam-saturated air resists temperature drops when cold food enters. This creates more stable cooking environments. Additionally, when steam condenses on food surfaces, it releases latent heat—the energy required to transform water vapor into liquid. This phase change transfers substantial thermal energy directly to food, accelerating and evening out cooking.

The combination eliminates hot and cold zones that occur with traditional convection or radiant cooking techniques. Steam prevents surface drying on exterior items while convection ensures interior positioning receives adequate heat. Result: consistent cooking across all chamber positions regardless of pan placement.

What Combis Replace

A properly specified combi oven can replace or supplement several dedicated pieces of equipment:

- Steamers: Full steam mode operates identically to dedicated steamers for vegetables, seafood, rice, anything requiring moist heat cooking

- Convection ovens: Dry convection mode handles roasting, baking, anything requiring traditional oven capability

- Smokers: Optional smoke generator attachments enable cold smoking and smoke-roasting (common on premium models)

- Hot holding cabinets: Low-temperature holding mode maintains food at service temperature without overcooking

- Sous vide setups: Precision temperature control (±1°F on premium models) enables low-temperature cooking matching sous vide results

- Proofing cabinets: Controlled temperature and humidity creates ideal bread proofing environments

This consolidation explains the "force multiplier" effect. One piece of equipment handles cooking techniques previously requiring five or six dedicated units. The space savings, utility reduction (one electrical connection versus five), and operational simplification provide genuine value beyond simple equipment cost comparison.

What Combis Cannot Do

Despite marketing suggesting combis handle "everything," several cooking applications remain better suited to dedicated equipment. Understanding these limitations prevents disappointment and ensures realistic expectations.

Pizza Crusts

Pizza demands high-temperature dry heat and thermal mass from stone or steel surfaces. Traditional pizza ovens operate at 700-900°F with radiant heat from above and below. Combis typically max out around 500°F and the steam capability (even when not engaged) affects crust development. The moisture content in the chamber, even minimal residual humidity, prevents proper browning and crisping. You CAN cook pizza in a combi. It just won't be very good pizza.

Soufflés

Soufflé rise requires precise still-air conditions. Any convection current or humidity variation affects the delicate structure during cooking. Some operators have successfully programmed combis for soufflés through experimentation, but it's tricky out of the box. Traditional convection ovens with fan-off capability handle soufflés more reliably.

Proper Browning

The Maillard reaction—the chemical process creating browned, caramelized surfaces on meat—requires hot, dry conditions. Combis struggle with this even in convection-only mode because residual moisture in the chamber interferes. The solution: reverse sear technique. Brown proteins first in a pan or on a flattop griddle, then transfer to the combi for precision cooking to target internal temperature. This delivers better results than attempting to brown in the combi itself.

Alternatively, cook to temperature in the combi, then finish on high-heat equipment for browning. Either approach works. The point: don't expect a combi to deliver the same browning as a 900°F broiler or screaming-hot cast iron pan.

The Limitations That Really Matter

Beyond specific dishes, combis have operational constraints worth understanding:

- Cannot be made cheaply: Entry-level combis start around $8,000 new. Quality units from Rational, Blodgett, or Convotherm retail $12,000-$30,000 depending on size. This is premium equipment commanding premium pricing.

- Cannot substitute for subject matter expertise: Programming sophistication requires understanding cooking principles. The machine executes instructions—it doesn't replace culinary knowledge.

- Cannot enable low-cost repairs: Service complexity puts most repairs beyond independent operator capability. Parts are expensive. Technicians are expensive. Knowledge is specialized. Budget accordingly.

Electric Dominance: Why Combis Buck the Gas Trend

Analysis of 283 sales reveals 68% electric units versus only 12% gas. This contrasts sharply with ranges where gas dominates overwhelmingly. The preference reversal reflects fundamental differences in combi oven design and operational priorities.

Alto-Shaam CTC10-20E electric combi—three-phase power delivers consistent temperature control superior to gas alternatives

Why Electric Wins for Combis

Temperature consistency: Electric heating elements deliver more stable, predictable temperatures than gas burners. Precision control matters enormously for combi applications—maintaining 165°F for sous vide cooking or 185°F for proofing requires tight tolerance. Electric elements respond to thermostat adjustments more precisely than gas flames.

Operational efficiency: Three-phase electric power converts to heat more efficiently than gas combustion. For equipment running many hours daily, this efficiency translates to meaningful operating cost savings. The initial three-phase infrastructure installation costs more, but savings compound over the equipment's service life.

Humidity control compatibility: Steam injection systems integrate more easily with electric heat. Gas combustion produces moisture as a byproduct (water vapor from burning hydrocarbons), complicating precise humidity management. Electric heat generates no moisture, allowing steam injection to control chamber humidity completely.

Installation simplicity: Electric combis eliminate gas line requirements, gas pressure regulation, combustion air supply, and flue venting complexity. You still need substantial electrical infrastructure, but avoiding gas systems reduces installation variables.

When Gas Makes Sense

Gas combis serve specific scenarios despite electric advantages:

- Facilities without adequate electrical capacity (insufficient panel space, service limitations, three-phase unavailable)

- Energy cost structures heavily favoring gas (some regions have electricity costs 3-4X natural gas on BTU basis)

- Operations prioritizing heat-up speed over temperature precision (gas reaches operating temperature faster)

- Retrofit installations where electrical upgrades would be prohibitively expensive

Gas combis work. They cook. They steam. But they sacrifice some precision and efficiency for speed and infrastructure flexibility. The 12% gas market share reflects these specific use cases rather than mainstream preference.

The Three-Phase Reality

75% of auction units specify three-phase power. This isn't optional for most commercial combis—it's engineered into the design. Three-phase power delivers electricity more efficiently than single-phase for high-wattage equipment. The difference matters over thousands of operating hours annually.

Not all facilities have three-phase service available. Adding it requires substantial electrical work: panel upgrades, new service entrance, possibly utility company involvement. This isn't trivial expense—budget $5,000-$15,000 for three-phase installation depending on existing infrastructure.

Single-phase combis exist (typically smaller countertop models), but they cost more to operate and offer fewer model options. If your facility has three-phase service, specify three-phase equipment. If you don't have it, determine installation cost before committing to combi purchase. A $3,000 auction combi becomes $18,000+ project when three-phase installation is required.

Voltage Configuration Flexibility

Many commercial combis accept multiple voltage configurations: 208/240V, 208V, 240V, 480V can often be field-configured during installation. Consult your specific unit's specifications to verify. This flexibility simplifies matching equipment to facility capabilities. But three-phase versus single-phase cannot be converted—that's fundamental to equipment design.

Size and Scale: Matching Equipment to Operation

Combi ovens span dramatic size range from compact countertop units to massive roll-in rack systems. Proper sizing matches capacity to actual output requirements without overbuying capability or constraining production.

Countertop Units: The Compact Solution

Countertop combis (4.6% of sales) serve small cafés, restaurants with low seat counts (4-50 seats), food trucks, ghost kitchens, bakeries, and operators needing supplemental combi capacity beyond existing equipment. Most countertop units accept half-sheet pans due to size constraints—typically 6-pan capacity maximum.

Countertop combi configuration—half-sheet capacity ideal for small operations without floor space for full-size units

Output limitations stem from capacity rather than recovery time. Unlike pizza ovens or fryers where temperature recovery creates bottlenecks, combis maintain consistent temperatures regardless of load size. The constraint is simply how much food fits. A 6-half-pan unit processes 6 half-pans. No downtime "getting back to temp" between loads.

Countertop units typically operate on 208-240V power (sometimes 120V for smallest models). Installation footprint is compact—essentially countertop placement with electrical connection, water supply, and drain line. The modest infrastructure requirements make countertop combis attractive for operations with space constraints or limited utility capacity.

Standard Full-Size: The Workhorse

Standard combis represent the market majority—the configuration most operations actually need. Available in half-sheet or full-sheet pan capacities, these units typically accommodate 6-10 pans depending on model. This is the sweet spot for restaurants, busy food trucks, ghost kitchens, and larger bakeries.

Most operations deploy one or two of these units. Stacked pairs are common—double the capacity without doubling floor space. The vertical configuration creates dedicated combi stations handling substantial production volume efficiently.

Stacked Rational iCombi Pro configuration—doubling capacity without floor space penalty, common in production kitchens

Standard units require dedicated electrical circuits (typically 208-240V three-phase), water supply (3/4" line, 21-87 PSI), and drain line for wastewater. The installation cadence matches commercial cooking equipment generally—utility hookups, ventilation if required, and proper clearances. Not trivial, but straightforward for commercial kitchen installations.

Roll-In Rack: The Production Beast

Roll-in rack combis (10.6% of sales) serve institutional applications: large restaurants, hotel kitchens, dining halls, cafeterias, buffet operations, catering companies, and any high-volume production facility. These monsters cook massive volumes at once using dedicated rolling rack systems.

Blodgett BLCT-202 roll-in rack combi—full-size sheet pan capacity for institutional-scale production, commanding $6,000-$8,500 auction pricing

Available in half-sheet and full-sheet configurations, roll-in racks accommodate 20+ pans (sometimes 40+ on largest models) using specialized rolling rack systems. The racks wheel directly into the combi chamber, eliminating individual pan loading. For high-volume operations, this efficiency difference is substantial—load the rack at prep station, wheel to combi, start cooking cycle.

Despite massive size, basic installation requirements mirror standard units: electrical hookup (often 480V for roll-in models), water line, drain line. It's simply... big. The physical footprint requires dedicated floor space and adequate ceiling clearance for door opening. But the utility requirements are conceptually identical to smaller combis.

Roll-in rack combis command premium auction pricing ($6,000-$8,500 typical) reflecting their substantial capability and limited buyer pool. These units serve specialized applications. Most restaurant operators don't need roll-in capacity. But for operations that do, nothing else suffices.

- Countertop: Under 50 seats, limited menu using combi, supplemental capacity, space-constrained installations

- Standard 6-pan: 50-100 seats, moderate combi reliance, standard restaurant applications

- Standard 10-pan: 100-200 seats, heavy combi reliance, production-focused operations

- Roll-in rack: 200+ seats, institutional volume, multiple serving periods daily, catering operations

These guidelines represent starting points. Actual sizing depends on menu composition, cooking technique preferences, and workflow design. Operations relying heavily on combi cooking need larger capacity than those using combis supplementally.

Critical Inspection Points for Auction Buyers

Commercial combis sold at auction arrive untested in most cases. The complexity of proper testing (electrical connection, water supply, drainage) makes preview evaluation impractical. Visual inspection becomes the primary decision tool. Unlike ranges where mechanical simplicity enables confidence in functional assessment, combi complexity requires different evaluation strategies.

Completeness: The Primary Indicator

The single most important inspection criterion: is the unit complete? Doors, handles, control panels, interior racks, side panels—all present and intact? With combi ovens fetching such premium pricing, complete units retired from service can be safely assumed to have been operational when removed. Restaurants don't retire $15,000 working equipment casually.

Complete combi with all panels intact, doors functioning, controls present—strong indicator of working condition when retired

Units with missing panels, removed components, or obvious "adjustments" tell different stories. These units have likely been messed with by someone attempting repair. DIY combi repair frequently makes problems worse. Every part, every screw, is expensive. Very expensive. These things know how valuable they are and price accordingly. When panels are missing, it's usually because someone already tried fixing it and failed.

Rational iCombi Pro with missing side panel—red flag indicating previous repair attempts, suitable for parts harvesting rather than restoration

Door Assembly Condition

Door problems are fairly common wear items on combis. Hinges fail from repeated opening/closing cycles. Gaskets compress over time losing seal integrity. Latching mechanisms wear. But door damage doesn't necessarily disqualify units from service—it indicates required repairs, not catastrophic failure.

Rational iCombi Pro with broken door hinge—still commanded $3,000+ auction price because remainder of unit was complete and functional

This example demonstrates the completeness principle: a $3,000+ sale despite obvious door damage occurred because the rest of the unit was intact. Buyers calculated door repair cost and determined the total investment (purchase + repair) still delivered value versus new equipment. Door assemblies are expensive but available. The critical factor: the unit's core systems (steam generation, heating elements, control boards) remained complete.

Inspect door operation even when non-powered. Does the door open and close smoothly? Are hinges visibly damaged or bent? Does the gasket appear compressed or torn? These visual cues indicate repair needs without requiring powered testing.

Control Panel Assessment

Control sophistication varies dramatically across combi oven generations. Older mechanical controls use physical buttons, switches, and timers. Modern digital panels feature touchscreens, WiFi connectivity, smartphone integration, and complex programming interfaces. Both styles work when functional, but damage implications differ.

Pre-2017 mechanical controls—durable, straightforward, lacking smartphone integration but fundamentally reliable

Modern WiFi-enabled control panel with touchscreen—Connected Cooking capability enabling remote monitoring and recipe integration

Mechanical control panels are durable and straightforward. Look for cracked or missing knobs, non-responsive buttons, or visible water damage around controls. These issues are typically repairable. Digital panels with touchscreens provide enhanced capability but cost significantly more to repair or replace. Check for cracked screens, non-responsive touch areas, or visible liquid damage behind displays. Control board replacements run $500-$2,000 depending on model—factor this into bidding if panel damage is evident.

The control technology era matters. Around 2017, Rational introduced "Connected Cooking" smartphone integration. Other manufacturers followed suit. Today most combis feature connectivity as standard. For chefs who use these features, older units feel limited. For chefs who don't care about remote monitoring, older units cook identically at substantial cost savings.

Interior Cavity Examination

The cooking chamber reveals operational history. Open the door and examine interior surfaces for:

- Cleanliness: Clean interiors suggest proper operational care. If operators maintained cleaning standards, they likely followed maintenance protocols for water systems, steam generators, and heating elements.

- Pan rack condition: Are racks present? Do they slide smoothly? Bent or damaged racks indicate rough handling but replacement cost is modest.

- Visible component damage: Look for obvious issues—missing spray nozzles, damaged heating elements, broken temperature probes. These aren't deal-breakers but indicate repair needs.

- Water staining or mineral deposits: White crusty buildup indicates hard water exposure. This affects steam generators, spray nozzles, and water lines. Not catastrophic, but signals potential maintenance neglect.

Unlike ranges or dishwashers where interior cleanliness strongly correlates with functionality, combis are more complex. A dirty cavity doesn't guarantee mechanical failure. But cleanliness indicates the operator's maintenance culture—if they cleaned regularly, they probably maintained properly across all systems.

External Panel and Chassis Condition

Examine the unit's exterior systematically:

- All panels present and attached: Missing panels almost always indicate previous repair attempts. Parts were removed and never replaced. This is a major red flag.

- Damage patterns: Cosmetic dents from moving/transport are normal. Localized damage around specific access panels suggests someone opened the unit to work on internal components. What were they fixing?

- Rust or corrosion: Stainless steel resists rust but isn't immune. Heavy corrosion indicates water exposure or improper storage. Surface rust on fasteners is cosmetic; rust on structural components matters.

- Modification evidence: Look for drilled holes, added brackets, non-factory attachments. Modifications sometimes improve functionality but often indicate problem-solving attempts by previous operators.

Water System Connections

Combis require water supply and drainage. Inspect connection points for visible damage, corrosion, or previous repair attempts. Water line fittings should be intact without obvious leaks or jury-rigged repairs. Drain connections should be complete. Missing or damaged water system components indicate either incomplete removal or failed repair attempts.

The Specification Plate

Specification plate detailing model number, voltage, phase, and electrical requirements—critical information for installation planning

Every combi has a specification plate listing:

- Model number and serial number

- Electrical requirements (voltage, phase, amperage)

- Water supply specifications (sometimes)

- Manufacturing date

- Regulatory certifications

This plate provides critical installation planning data. Verify voltage and phase requirements match your facility capabilities before bidding. Record the model number for parts research if needed post-purchase. The serial number enables warranty verification (unlikely on auction units, but worth checking for very recent models).

The Auction Reality for Combis

Unlike ranges that are 99.9% functional if complete, combis carry genuine risk. The complexity means multiple potential failure points: steam generators, heating elements, control boards, door mechanisms, water valves, sensors. You cannot test these systems during preview.

The strategy: bid as if repairs will be needed. If you purchase a combi for $2,000 and budget $1,500 for professional evaluation and potential repairs, your total investment is $3,500. Compare this to $12,000-$18,000 for comparable used equipment from dealers with warranties. The math works if you accept repair risk. The math fails if you expect $2,000 auction combis to arrive perfect.

Complete units with intact panels, functioning doors, and clean interiors have the highest probability of functionality. Incomplete units with missing panels are parts machines—buy them for component harvesting, not restoration.

The Two-Tier Auction Strategy: Parts vs Functional

Combi oven auction strategy divides into two distinct approaches based on completeness assessment and risk tolerance. Unlike other equipment where "fixing it up" is straightforward, combis require different thinking: parts harvesting versus functional restoration.

Tier One: Parts Harvesting

The price of a door handle from a parts unit at auction may be less than ordering a new door handle. Every component—doors, panels, control boards, heating elements, steam generators, sensors, racks, fasteners—is expensive. Very expensive. This reality creates legitimate value in units unsuitable for restoration.

Parts-only combi—incomplete units unsuitable for restoration but containing thousands of dollars in reusable components

Units selling under $500 often fall into parts tier territory. Missing panels, obvious damage, incomplete assemblies, or known failures make these unsuitable for service restoration. But they contain valuable components for operators with:

- Technical capability: Understanding systems well enough to remove and repurpose components correctly

- Multiple combis: Operators running several units can harvest parts for fleet maintenance

- Service relationships: Appliance repair companies buy parts units to support customer base

- Patience and skill: DIY-capable individuals willing to invest time in component removal and testing

Specific part values (OEM pricing):

- Door assemblies: $800-$2,000 depending on model

- Control boards: $500-$2,000 depending on sophistication

- Steam generators/boilers: $600-$1,500

- Heating elements: $200-$600

- Temperature sensors/probes: $100-$300

- Door gaskets: $50-$150

- Pan racks: $80-$200 each

A combi selling for $300 at auction may contain $4,000+ in parts at OEM pricing. For operators capable of harvesting components, this represents exceptional value. The catch: you need technical knowledge to remove parts without causing damage and skill to install them correctly in working units.

Tier Two: Functional Restoration

Units selling above $1,000 typically represent functional restoration candidates. Complete assemblies, intact panels, operational-looking components, and reasonable cosmetic condition indicate these units were working when retired. The risk: unknown functionality without powered testing.

The restoration strategy: purchase with repair budget built-in. If you buy a combi for $2,500 and allocate $2,000 for professional inspection and potential repairs, your total investment is $4,500. Compare this to $12,000-$18,000 for equivalent used equipment from dealers with warranties. The math works if repairs are modest or unnecessary. The math fails if the unit requires $5,000+ in component replacement.

Priority inspections after purchase:

- Powered testing: Once electrically connected, verify the unit powers on, control panel functions, heating elements operate, and basic cycles complete

- Steam generation: Confirm steam generator produces steam at appropriate rates and maintains desired humidity levels

- Temperature accuracy: Verify actual cavity temperature matches set temperature using independent thermometer

- Door seal integrity: Check for steam escaping around door during operation indicating gasket failure

- Water system function: Confirm water intake operates properly and drainage evacuates completely

Professional technician inspection typically costs $200-$500 depending on location and service company. This investment provides expert assessment of what works, what needs attention, and estimated repair costs. For high-value auction purchases ($2,000+), professional inspection is money well spent before attempting repairs.

Who's Buying What

| Buyer Type | Target Tier | Typical Strategy |

|---|---|---|

| Restaurant operators | Functional ($1,000+) | Complete units, budget for repairs, professional inspection |

| Multi-unit operators | Both tiers | Functional for service, parts for fleet maintenance |

| Appliance repair companies | Parts (under $500) | Component inventory for customer support |

| Equipment dealers | Functional ($2,000+) | Refurbish and resell with warranties |

| Technical DIY individuals | Both tiers | Parts for own use, restoration projects |

| Institutional maintenance | Parts (under $500) | Support existing equipment inventory |

Installation Requirements: The Serious Infrastructure

Combi ovens demand substantial infrastructure beyond simple placement. Electrical service, water supply, drainage, and ventilation all require professional installation. This isn't DIY-friendly equipment—the complexity and utility requirements necessitate licensed contractors.

Electrical Service Requirements

Most combis operate on 208-240V three-phase power. Some models accept 480V (typically roll-in racks). Smaller countertop units occasionally operate on 120V single-phase, but this represents the minority of equipment. The three-phase requirement creates installation complexity for facilities lacking this service.

Typical electrical specifications by size:

- Countertop units: 120-240V, 20-40 amps, single or three-phase depending on model

- Standard 6-10 pan units: 208-240V, 40-60 amps, three-phase standard

- Roll-in rack units: 208-480V, 60-100+ amps, three-phase required

Many combis offer voltage configuration flexibility during installation—the same unit can be field-configured for 208V or 240V operation. But single-phase versus three-phase cannot be converted. This is fundamental to equipment design. If a unit specifies three-phase, your facility needs three-phase service.

Dedicated circuits are mandatory. Combis draw substantial, continuous amperage during operation. Sharing circuits with other equipment creates nuisance breaker trips and potential fire hazards. Licensed electricians size circuits appropriately based on equipment specifications.

Beyond the dedicated circuit, no particular electrical "gotchas" exist. This is straightforward high-amperage equipment installation requiring professional expertise but not exotic capabilities.

Water Supply Specifications

Combis require incoming water for steam generation and self-cleaning cycles. Standard specifications call for:

- Pressure: 21-87 PSI (typical municipal water supply range)

- Line diameter: 3/4" standard for most models

- Water quality: Soft water highly recommended (hard water damages steam generation systems)

- Shutoff valve: Dedicated valve required for service and emergency shutoff

Soft water is highly recommended. Hard water deposits impact boilers, nozzles, and water lines throughout the combi. Manufacturers recommend 6-month checkups to assess limescale and mineral buildup. This preventive maintenance helps avoid costly future repairs. Some Rational units include automatic descaling features with specific limescale parameter tolerance—consult your model's manual for exact details.

Water hardness above 7 grains per gallon typically requires water softening systems or chemical treatment. Like dishwashers, prevention beats remediation. Installing water softeners on combi supply lines costs $300-$800 but protects $15,000 equipment investments. The math is straightforward.

Wastewater Drainage

Combis generate wastewater from condensate, self-cleaning cycles, and steam generation. Drainage systems must handle this volume effectively. Installation requirements include:

- Drain line diameter: Typically 3/4" to 1" depending on model

- Installation compliance: Follow local plumbing codes for commercial equipment drainage

- Trap requirements: Air gap or P-trap prevents drain backup contaminating cooking chamber

- Temperature considerations: Wastewater can be hot—ensure drain materials are rated appropriately

Unlike dishwashers which may require grease trap connections, combis typically drain to standard commercial waste lines. The wastewater contains condensate and cleaning solution but limited grease content. Verify local code requirements—some jurisdictions have specific combi oven drainage regulations.

Ventilation Requirements

Generally, combis require Type I hoods (grease-rated ventilation). Some models include self-contained hood systems (ventless configurations), but units producing exhaust gases from heating elements need proper hood systems to vent carbon monoxide and cooking byproducts safely.

Compared with ranges and fryers, combis produce less grease-laden exhaust volume unless equipped with optional smoker accessories. The lighter-duty classification affects CFM requirements. A good rule of thumb for combi ovens and similar light-duty equipment: 300 CFM per linear foot of hood.

Blodgett combi with integrated ventless hood—self-contained exhaust system eliminating expensive hood installation requirements

Ventless combi configurations include built-in filtration and exhaust management systems. These units cost more upfront but eliminate $10,000-$25,000 hood installation expenses. For facilities lacking adequate ventilation infrastructure or where hood installation is impractical, ventless combis provide compelling value despite premium pricing.

Make-up air considerations apply similarly to ranges: kitchen hoods exhaust substantial air volume, creating negative pressure without make-up air systems. This affects door operation, pushes kitchen air into dining areas, and reduces hood efficiency. Budget for make-up air even when not legally mandated—the operational benefits justify investment.

Clearance and Spacing Requirements

The primary spacing consideration: keeping hot appliances (ranges, fryers, ovens) away from combis. Individual specifications vary between manufacturers and models but general guidelines include:

- Small countertop units: 3/8" clearance to walls typically sufficient (well-insulated units)

- Standard full-size units: 2" clearance for larger models

- Door swing clearance: Account for full door opening arc—doors swing outward requiring front clearance

- Service access: Allow adequate space for panel removal during maintenance

- Heat from adjacent equipment: Varies by equipment type—maintain adequate separation from ranges, ovens, fryers

These specifications should be verified against your specific model's installation manual before final placement. Manufacturers provide detailed clearance diagrams accounting for door operation, service access, and heat dissipation requirements.

Professional Installation Cost Expectations

Budget $2,000-$5,000 for professional combi installation in facilities with adequate existing infrastructure (three-phase power present, water lines available, drainage accessible, hood in place). This covers:

- Final electrical connection and testing

- Water supply line connection with shutoff valve

- Drainage system connection

- Equipment positioning and leveling

- Initial system testing and verification

If infrastructure upgrades are required:

- Three-phase electrical service: $5,000-$15,000

- Water line installation/extension: $500-$2,000

- Hood system installation: $10,000-$25,000

- Make-up air system: $3,000-$10,000

- Water softening system: $300-$800

These costs can dwarf the equipment itself. A $3,000 auction combi becomes a $25,000+ project when complete infrastructure installation is required. This is why verifying existing infrastructure before purchasing equipment is critical. Know what your facility can support before bidding.

Brand New Scratch & Dent: The Premium Opportunity

Analysis of the highest-value combi oven sales reveals brand-new scratch-and-dent units dominating premium pricing. The top 10 sales ($7,250-$13,500) are predominantly BNSD units from Rational, Blodgett, and Cleveland. These ovens are cosmetically imperfect from shipping damage or minor manufacturing defects but functionally identical to showroom models.

The BNSD Value Proposition

- BNSD median price: $3,450 vs $299 for used equipment (11.5X premium)

- Retail comparison: 40-60% discount from retail pricing

- Top sale: Rational SCC WE 101G countertop gas combi at $13,500 (retail $30,000+)

- Volume: 92 BNSD units (32.5% of auction volume)

- Immediate availability: Next-day pickup versus 8-16 week manufacturer lead times

The compelling reality: brand-new commercial-grade combi ovens at substantial discounts simply because of cosmetic damage invisible in back-of-house installations. No customer will ever see the dent in the side panel.

Blodgett roll-in rack combi in original shipping crate—brand new equipment commanding auction premiums while delivering massive retail savings

Major foodservice equipment distributors and manufacturers reject cosmetically imperfect units from retail channels. A dent during shipping, scratched stainless steel from warehouse handling, damaged packaging with perfect equipment inside—these scenarios create BNSD inventory flowing to auction where back-of-house buyers recognize value propositions retail customers won't accept.

Alto-Shaam CTX4-10E brand new in box—boilerless technology, 380-415V three-phase, full retail functionality at auction pricing

Common BNSD damage types include dented panels, scratched surfaces, bent legs (straightened easily), damaged packaging (equipment itself perfect), or minor surface imperfections on stainless steel. These cosmetic issues don't affect cooking performance, temperature accuracy, steam generation, or equipment longevity. The functionality is identical to showroom units.

Cleveland OEB-10.10 BNSD—light cosmetic damage visible but functionality perfect, commanding $6,800 auction price versus $16,000+ retail

BNSD Advantages Beyond Price

Immediate availability: Ordering new combis from manufacturers or distributors involves 8-16 week lead times typically. Equipment gets manufactured, shipped to distributor, delivered on scheduled timeline. BNSD units at auction? Available next day. Pick up the day after auction closes. For operations replacing failed equipment or opening on tight timelines, this immediate availability provides value beyond simple price savings.

Brand new Rational iCombi Pro in two months from ordering? Standard timeline. Brand new scratch-and-dent Rational iCombi Pro tomorrow? Absolutely possible through auction. This time compression matters enormously for operations under deadline pressure.

Known specifications: BNSD units are brand new, so specifications match manufacturer published data exactly. Electrical requirements, water specifications, dimensions, capacity—all information is current and accurate. Used equipment may have modifications, repairs, or alterations affecting specifications. BNSD eliminates this uncertainty entirely.

Latest technology: BNSD inventory represents current-generation equipment with newest features. Connected Cooking integration, smartphone app compatibility, advanced programming, self-cleaning sophistication—these capabilities matter to operations prioritizing technology advantages. Used equipment from 5-10 years ago lacks these features regardless of mechanical condition.

Blodgett BLCT-6E-H ventless mini combi BNSD—integrated hood eliminates $10,000-$25,000 ventilation installation costs

BNSD Bidding Strategy

BNSD units attract competitive bidding because value is obvious to experienced buyers. Everyone recognizes the opportunity. This means discipline in maximum bid setting becomes critical. Getting caught in auction fever and bidding past value thresholds negates the BNSD advantage.

Research retail pricing before auction. If a comparable new combi retails for $18,000, set maximum BNSD bid around $9,000 (50% of retail). This provides substantial savings while accounting for lack of manufacturer warranty and minor cosmetic issues. Bidding to $15,000 to "win" reduces savings to marginal levels.

The reality: another BNSD combi will appear at the next auction. We have the privilege of receiving manufacturer overstock and scratch-and-dent inventory consistently. Supplies flow regularly because normal shipping and warehousing operations continuously generate cosmetically imperfect equipment. Walking away from one auction knowing another opportunity arrives shortly prevents overpaying through competitive heat-of-the-moment bidding.

The math must work. A $9,000 BNSD Rational iCombi Pro versus $18,000 retail represents $9,000 savings. Installation costs identical either way. You're simply paying half price for identical capability with minor cosmetic compromise. That's genuine value. At $15,000 auction price, you're paying near-retail pricing without warranty protection. The value proposition collapses.

Bidding Strategy by Price Tier

The 283-unit auction database reveals clear price tiers corresponding to condition, completeness, and functionality probability. Understanding these tiers helps calibrate bids to acceptable risk tolerance and expected post-purchase investment.

Under $100: Pure Parts Territory

Units selling below $100 (18.7% of volume) are parts machines exclusively. Severe damage, missing major assemblies, obvious catastrophic failure, or incomplete equipment characterizes this tier. Don't expect functional units. You're buying component inventory, not cooking equipment.

Value proposition: harvesting specific parts for existing combis or building parts inventory for future repairs. The price of a single OEM door handle often exceeds $100. If the parts unit has an intact door assembly, the purchase justifies itself immediately for operators needing that component.

$100-$500: The Risk Tier

This tier (29.3% of sales) represents highest risk and potentially highest reward. Units appear reasonably complete but lack obvious functionality indicators. Unknown condition, older models, cosmetic issues, or unclear retirement reasons characterize this tier.

Strategy: bid assuming complete restoration will be required. If you purchase at $300 and budget $3,000 for professional evaluation and repairs, your total investment is $3,300. Compare this to $12,000-$18,000 for equivalent used equipment from dealers. The math works if repairs are moderate. The math fails if the unit needs $5,000+ in component replacement.

This tier suits buyers with:

- Technical capability to perform basic troubleshooting

- Access to affordable professional service

- Risk tolerance for potential non-functional units

- Time to invest in restoration projects

$500-$1,000: Better Odds Territory

Units reaching this tier (8.1% of sales) typically show better cosmetic condition, more complete assemblies, and characteristics suggesting functionality when retired. Buyers in this tier are expressing confidence through higher bids—they see something indicating value beyond parts harvesting.

Functionality probability increases substantially versus sub-$500 units. These combis likely worked when removed from service. The unknown: what specific issues exist and what repairs are needed. Budget $1,500-$2,500 for professional inspection and potential repairs on top of purchase price.

$1,000-$2,000: Probable Functionality

This tier (13.4% of sales) represents recent models, good cosmetic condition, complete assemblies, and characteristics strongly suggesting operational capability. Buyers are paying premiums because visible inspection indicates quality equipment.

At this price point, expect minor repairs at most. A $1,500 combi purchase might need $500 in door gasket replacement and professional cleaning. Total investment $2,000 for a working combi that would cost $12,000-$15,000 from dealers. The value proposition remains strong.

$2,000-$3,000: High Confidence Territory

Units commanding $2,000-$3,000 (8.1% of sales) are near-certain functional. Complete assemblies, excellent cosmetic condition, recent model years, recognizable quality brands. These purchases minimize risk substantially while still delivering auction value versus retail or dealer pricing.

For operators lacking in-house technical capability or unwilling to accept functionality risk, this tier provides peace of mind. You're paying auction premiums for reduced uncertainty. The units work or need minimal attention to achieve operational status.

$3,000-$10,000: BNSD and Premium Territory

This tier (21.6% of sales combined) represents brand-new scratch-and-dent units and premium used equipment in exceptional condition. These purchases eliminate functionality risk entirely. BNSD units are brand new with manufacturer specifications. Premium used units are recent models from high-end operations.

Competition is fierce in this tier because value is obvious. Set maximum bids based on retail pricing research and maintain discipline. A BNSD combi retailing at $18,000 makes sense at $9,000 auction price. At $15,000? The savings don't justify buying at auction versus retail with full warranty protection.

Over $10,000: Specialty and Exceptional Units

Only 0.7% of sales exceed $10,000. These represent brand-new premium models (Rational iCombi Pro, large roll-in racks), specialty configurations (gas combis, specific voltage requirements), or exceptional condition used units from premium operations. Buyers at this level are acquiring specific equipment to meet precise requirements rather than hunting general value.

The Bidding Discipline Requirement

Auction fever affects combi sales more than commodity equipment. The technology appeal, brand reputations, and premium positioning create emotional bidding. Combat this by setting maximum bids before auction starts. Write them down. Commit to walking away when bidding exceeds your threshold.

Another combi will appear next auction. We move substantial combi volume—supplies are consistent. Missing one auction knowing consistent opportunities exist prevents overpaying through competitive heat-of-the-moment decisions. The goal isn't winning auctions. The goal is acquiring equipment at prices delivering genuine value. Sometimes that means walking away.

Long-Term Ownership: Maintenance and Reality

Combi ovens reward regular maintenance with decade-plus service lives. But their complexity means maintenance requirements exceed ranges or convection ovens substantially. The technology that makes combis valuable also makes them expensive to maintain and repair.

Daily Maintenance Protocols

Clean your ovens, people! Yes, self-clean cycles are fantastic tools. But if you drop and splatter something during service, wipe it up immediately. Don't leave it for self-cleaning to handle. Many units include spray nozzle attachments allowing cavity cleaning during nightly closing procedures. This needs to be part of your daily routine.

Combis splatter substantially during cooking—steam, condensate, food particles. Manual cleaning should address everything visible. Then run self-clean cycles to handle what you don't see. The self-clean feature isn't a substitute for daily maintenance—it's a supplement to proper cleaning protocols.

Daily checklist:

- Wipe interior surfaces with approved cleaning solutions

- Remove and clean pan racks

- Check door gasket for debris or damage

- Inspect drain for clogs or buildup

- Verify spray nozzles are clear (if visible)

- Run rinse cycle to clear water systems

Weekly and Monthly Maintenance

Weekly maintenance should include thorough interior cleaning beyond daily protocols. Remove all racks, inspect steam nozzles (if accessible), check water system connections for leaks, and verify door operation remains smooth. Run full self-clean cycles weekly even with daily cleaning—this addresses buildup in areas manual cleaning cannot reach.

Monthly, check water hardness if your combi includes monitoring capability. External water filters should be inspected and replaced as needed per manufacturer recommendations. Follow manufacturer best practices for flushing and maintaining internal water systems. These units cost as much as new cars and will last as long if properly maintained. Neglect water system maintenance and expensive repairs follow inevitably.

Manufacturer-Recommended Professional Service

Most manufacturers recommend 6-month professional inspections assessing limescale buildup, component wear, and system functionality. This preventive maintenance catches minor issues before they become catastrophic failures. The service typically costs $300-$600 but prevents $3,000-$5,000 emergency repair situations.

Professional service includes:

- Water system descaling and flushing

- Steam generator inspection and cleaning

- Temperature accuracy verification and calibration

- Door gasket assessment and replacement if needed

- Control system diagnostics

- Safety system testing

Common Wear Items and Failure Points

Despite robust construction, certain components wear predictably:

- Door problems: Hinges, gaskets, latching mechanisms—all wear from repeated operation. Door repairs are common. Remember: sensors in door assemblies require rewiring during component replacement.

- Weak steam output: Usually calcium buildup in water systems, nozzles, or steam generators. Descaling treatments resolve most cases. Severe buildup may require component replacement.

- Uneven heating: Element issues or circulation fan problems. Elements are replaceable but expensive ($200-$600 depending on model).

- Temperature accuracy drift: Faulty thermostats or temperature probes. These sensors are relatively inexpensive ($100-$300) but require proper installation and calibration.

When to Call Professionals vs DIY Attempts

If you don't know exactly what you're doing, call professionals. Period. These are German cars—if you know, you know. If you don't, call someone who does. You can DIY yourself into much more costly problems.

The system interconnectedness means apparently simple repairs affect multiple subsystems. Door handle replacement involves sensors, relays, and actuators. Control panel repairs require understanding electrical systems and programming. Steam generator service affects water systems, safety mechanisms, and temperature management. Attempting repairs without comprehensive understanding creates cascading failures.

Professional repair costs vary by region and service provider, but typical ranges:

- Service call/diagnostic: $150-$300

- Door gasket replacement: $200-$400 (parts + labor)

- Heating element replacement: $400-$800 (parts + labor)

- Steam generator service/replacement: $800-$2,000 (parts + labor)

- Control board replacement: $1,000-$3,000 (parts + labor)

These costs shock operators accustomed to range or oven repairs. But combis aren't ranges. The complexity justifies professional service costs. Attempting repairs without expertise typically makes problems worse and more expensive.

When Combis Are "Done"

Simple answer: totaled. Cost to repair exceeds cost of replacement—whether that's a new combi or a great deal on scratch-and-dent replacement at PCI Auctions (shameless plug section). Everything else is worth paying the piper, gritting your teeth, and funding the repair.

True "done" scenarios are rare:

- Multiple catastrophic system failures (steam generator + control board + heating elements all failed simultaneously)

- Structural damage to chassis affecting system integration

- Safety system failures that cannot be repaired economically

- Water damage throughout electrical systems creating multiple failure points

Most combis never reach "done" status. They remain repairable throughout their service lives. The decision becomes economic: does repair cost justify continued operation or does replacement make more sense? For $15,000 combis, a $4,000 repair investment is rational. For a 15-year-old combi showing multiple wear issues, replacement may deliver better long-term value.

Final Assessment: The Force Multiplier Reality

Commercial combi ovens occupy unique territory in professional kitchens. They're not commodity equipment replaced when broken. They're capability upgrades that transform operational possibilities. This fundamental difference affects buying psychology, pricing dynamics, and ownership strategies.

Value Proposition Summary

- Median auction price: $525 vs retail $12,000-$30,000+

- BNSD premium tier: $3,450 median (40-60% off retail)

- Top brands: Blodgett ($4,000 median), Rational iCombi Pro ($1,250 median)

- Parts tier legitimacy: Under $500 units contain thousands in OEM component value

- Service life: 10-15+ years with proper maintenance

- Installation investment: $2,000-$5,000 standard, up to $25,000+ with full infrastructure upgrades

The auction market for combis differs fundamentally from ranges or dishwashers. The 11.5X BNSD premium ($3,450 vs $299) versus 2X premiums for other equipment reflects buyer willingness to pay for certainty when acquiring game-changing capability. BNSD combis eliminate risk while delivering substantial retail savings. This value proposition drives competitive bidding and premium pricing.

Brand hierarchy matters more for combis than commodity equipment. Rational commands cult following through genuine feature advantages—Connected Cooking, smartphone integration, sophisticated programming. Blodgett delivers Middleby Group engineering across the full size spectrum. Alto-Shaam battles brand perception despite quality construction. Convotherm provides solid German engineering without the Rational premium. These aren't interchangeable—choose based on feature requirements, budget constraints, and long-term capability needs.

Electric dominance (68% of market) reflects operational realities: temperature consistency, efficiency, humidity control compatibility. Gas combis serve specific scenarios but sacrifice precision for speed. Three-phase electrical requirements (75% of units) create installation complexity but deliver operational efficiency justifying infrastructure investment.

Critical inspection focuses on completeness. Missing panels, removed components, or obvious modifications signal previous repair attempts that likely failed. Complete units with intact assemblies, functioning doors, and clean interiors have highest probability of functionality. Incomplete units suit parts harvesting rather than restoration—valuable components without restoration viability.

The two-tier auction strategy separates parts harvesting (under $500) from functional restoration ($1,000+). Both approaches deliver value for appropriate buyers. Parts tier serves operators with technical capability and existing combi fleets. Functional tier serves operations seeking working equipment at substantial retail discounts while accepting repair risk.

Installation requires professional expertise and substantial infrastructure. Three-phase power, water supply, drainage, ventilation—all demand licensed contractors and proper permitting. Budget $2,000-$5,000 for standard installation, potentially $25,000+ if complete infrastructure upgrades are required. Know your facility capabilities before bidding. A $3,000 combi becomes a $20,000+ project when infrastructure installation is necessary.

BNSD opportunities dominate premium pricing tiers. The 32.5% BNSD volume percentage (92 units of 283 sales) exceeds other equipment categories substantially. This consistent supply from manufacturer overstock and cosmetic rejection creates regular opportunities for buyers prioritizing latest technology and certain functionality. The immediate availability (next-day pickup) provides additional value over 8-16 week manufacturer lead times.

Long-term ownership requires maintenance commitment and professional service relationships. Daily cleaning, weekly deep maintenance, 6-month professional inspections—these aren't optional. Neglect accelerates expensive repairs. Professional service costs are substantial but prevent catastrophic failures. The "German car" analogy is apt: sophisticated, expensive to maintain, worth it if properly cared for.

For operations contemplating combi acquisition, the decision tree is straightforward: Can your facility support three-phase power, adequate water supply, and proper ventilation? Do you have professional service relationships for complex repairs? Can you commit to proper maintenance protocols? If yes, combis deliver genuine operational advantages justifying investment. If no, address infrastructure and support limitations before acquiring equipment.

The force multiplier effect is real. Chefs lobbying annually for combis aren't chasing gadgets—they're recognizing capability transformation. Combined cooking techniques, precision control, smartphone monitoring, recipe programming—these features simplify workflow and expand menu possibilities. There are no dishes exclusive to combis, but the ability to combine techniques in one unit with superior control explains the evangelical following.

For auction buyers, success requires understanding the equipment's complexity, honestly assessing technical capability, budgeting for professional service, and maintaining bidding discipline despite competitive pressure. The goal isn't winning auctions—it's acquiring equipment at prices delivering genuine value. Sometimes that means walking away. Another combi appears next week. Supplies are consistent. Patience prevents overpaying.

Give your kitchen the tools it deserves. But understand what you're buying. Combis aren't plug-and-play equipment. They're sophisticated cooking systems requiring proper support. With realistic expectations, adequate preparation, and professional assistance, auction combis deliver exceptional value. Without these elements, they become expensive problems rather than capability multipliers.

Talk to your team. Your chefs. Your line cooks. Discuss workflow requirements, capability needs, feature priorities. By getting input from people who will actually use the equipment daily, you'll make informed buying decisions serving your operation for years. The combi oven can be the kitchen's ultimate force multiplier—if properly matched to your operational needs and supported throughout its service life.

Ready to Bid on Commercial Restaurant Equipment?

PCI Auctions offers 600-900 lots weekly of restaurant and foodservice equipment including commercial combi ovens, refrigeration, cooking equipment, and complete restaurant liquidations. Preview in person at our Manheim, Pennsylvania facility, inspect equipment before bidding, and leverage auction pricing for your operation.

View Current Auctions